Brokers' Picks Brokers' Picks

by Dorothy Hoffert

November 17, 2004

www.resourceworldmag.com

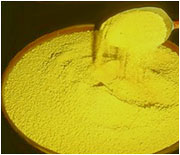

The increasing

price of uranium, also referred to as "yellowcake,"

has recently caused a great deal of market activity for the shares

of companies focused on uranium exploration - whether they are

grassroots or advanced projects. The price of uranium has increased

from US $12.75 per pound at the end of October 2003 to its current

levels of $20.00 per pound with prices expected to continue to

rise.

World consumption of uranium has been exceeding production for

a number of years. The shortfall has been made up through secondary

sources such as excess inventories, the dismantling and recycling

of nuclear weapons and used reactor fuel that has been reprocessed.

Concerns over shortages of oil and gas with resulting high prices

in these fossil fuels, along with environmental issues regarding

greenhouse gas emissions has fueled a new interest in nuclear

energy as the source of power to meet current and future global

demand for electricity.

Nuclear energy offers a clean and efficient alternative to energy

produced from coal, oil or natural gas. Electricity is produced

at lower costs and a nuclear generating plant does not produce

carbon dioxide emissions. New supplies of uranium will come at

a higher cost which, in turn, will continue to put upward pressure

on the price of uranium.

The Athabasca

Basin of northern Saskatchewan, Canada is the largest and richest

uranium producing region in the world and accounts for more than

33% of annual world production.

Cameco Corporation [CCO-TSX; CCJ-NY] is the world's largest,

low-cost uranium producer and supplies 20% of the world's consumption.

The company operates and owns a controlling interest in uranium

mines and mills at McArthur River, Key Lake and Rabbit Lake,

all located in the Athabasca Basin. The McArthur River Mine is

the world's largest, highgrade uranium deposit with proven and

probable reserves of 437 million pounds of U3O8. The average

ore grade is 25% U3O8 and is valued at US $10,000/ton, a gold

equivalent of 25 oz/ton. Given the above numbers, it is no wonder

why there is enormous interest in exploring for uranium in this

region of Canada.

The die-hard of the junior uranium explorers is JNR Resources

Inc. [JNN-TSXV]. The company first began its land acquisition

program in the Athabasca Basin in 1997. JNR joint ventured these

projects with Kennecott (between 1998 and 2002) which

made over $6 million in expenditures developing promising targets.

Unconformity-type uranium mineralization was discovered on the

Moore Lake property in 2000 and significant uranium mineralization

was intersected in the third hole of a 10-hole program, returning

0.442% U3O8 over 9.2 metres. In the fall of 2003, JNR formed

a joint venture on the Moore Lake property with International

Uranium Corp. [IUC-TSX]. The 2004 diamond drilling program

focused on following up the uranium mineralization in the Maverick

Zone. Assays released in August included 5.0 metres of 3.5% U3O8

and 6.2 metres of 5.14% U3O8 and results released in September

assayed 4.03% U3O8 over 10 metres which included a 1.4-metre

intercept 19.96% U3O8.

Northern Continental Resources Inc. [NCR-TSXV] also recognized

the growing need for economic sources energy and acquired a large

land package in the heart of the Athabasca Basin's most productive

zone. The Russell Project encompasses 39,378 hectares (93,305

acres) and is situated on strike and midway between the former

producing Key Lake deposit and the MacArthur River deposit and

west of the Moore Lake project. The property has year-round access.

There is a power line, and the all-weather road located along

the northwest boundary of the property is used to transport uranium

ore from the McArthur River Mine to Key Lake for processing.

Historic exploration conducted by SMDC (the predecessor

to Cameco) on the Russell Project resulted in the discovery of

the Grayling Zone and NCR's exploration has focused on this zone.

Diamond drill holes intersected sub-economic uranium mineralization

grading 3.45% U3O8 over 0.3 metres and 0.4% U3O8 over 3.75 metres

over a strike length of 800 metres. The holes encountered the

basal Athabasca Group unconformity at 320-350 metres below surface

within a zone of strong structural deformation and hydrothermal

alteration. Four other areas outside of the Grayling Zone have

been identified for further exploration. This year's initial

exploration program will include 60 km of line cutting and electromagnetic

surveys to confirm drill set-up locations and 3,600 metres of

diamond drilling in 10 holes.

Trading volumes in "uranium shares" has slowed down

in recent weeks. However, as exploration programs are ongoing,

more news from these companies will be forthcoming and the market

slow-down offers good opportunities for aggressive investors

to add shares of these companies to their portfolios as the long-term

uranium market outlook remains positive.

Other juniors active in the area are CanAlaska Ventures Ltd.

[CVV-TSXV], Consolidated Abaddon Resources Inc. [ABN-TSXV],

Formation Capital Corp. [FCO-TSX], Southern Cross Resources

Inc. [SXR-TSX] and United Carina Resources Corp. [UCA-TSXV]

to mention a few.

November 2004 www.resourceworldmag.com

Dorothy Hoffert

Dorothy Hoffert has been an Investment

Advisor for 20 years with a focus on the Mining Sector. Dorothy Hoffert has been an Investment

Advisor for 20 years with a focus on the Mining Sector.

She can be reached at Wolverton Securities at 604-662-5271.

Dorothy Hoffert, her clients and/or Wolverton directors, employees

or clients may own shares in any of the companies discussed.

________________

321gold Inc

|